Renters Insurance in and around Perry

Perry renters, State Farm has insurance for you, too

Your belongings say p-lease and thank you to renters insurance

Would you like to create a personalized renters quote?

- Warner Robins

- Houston County

Home Sweet Home Starts With State Farm

Your rented house is home. Since that is where you kick your feet up and relax, it can be beneficial to make sure you have renters insurance, especially if you could not afford to replace lost or damaged possessions. Even for stuff like your books, fishing rods, silverware, etc., choosing the right coverage can make sure your stuff has protection.

Perry renters, State Farm has insurance for you, too

Your belongings say p-lease and thank you to renters insurance

Why Renters In Perry Choose State Farm

Renters often underestimate the cost of refurnishing a damaged property. Just because you are renting a condo or property, you still own plenty of property and personal items—such as a bicycle, cooking set, desk, and more. All of these have value, which would be a real loss if damaged or destroyed. That's why you need renters insurance from State Farm. Why go with renters insurance from Nick Bedgood? You need an agent committed to helping you examine your needs and choose the right policy. With efficiency and wisdom, Nick Bedgood is here to help you discover the State Farm advantage.

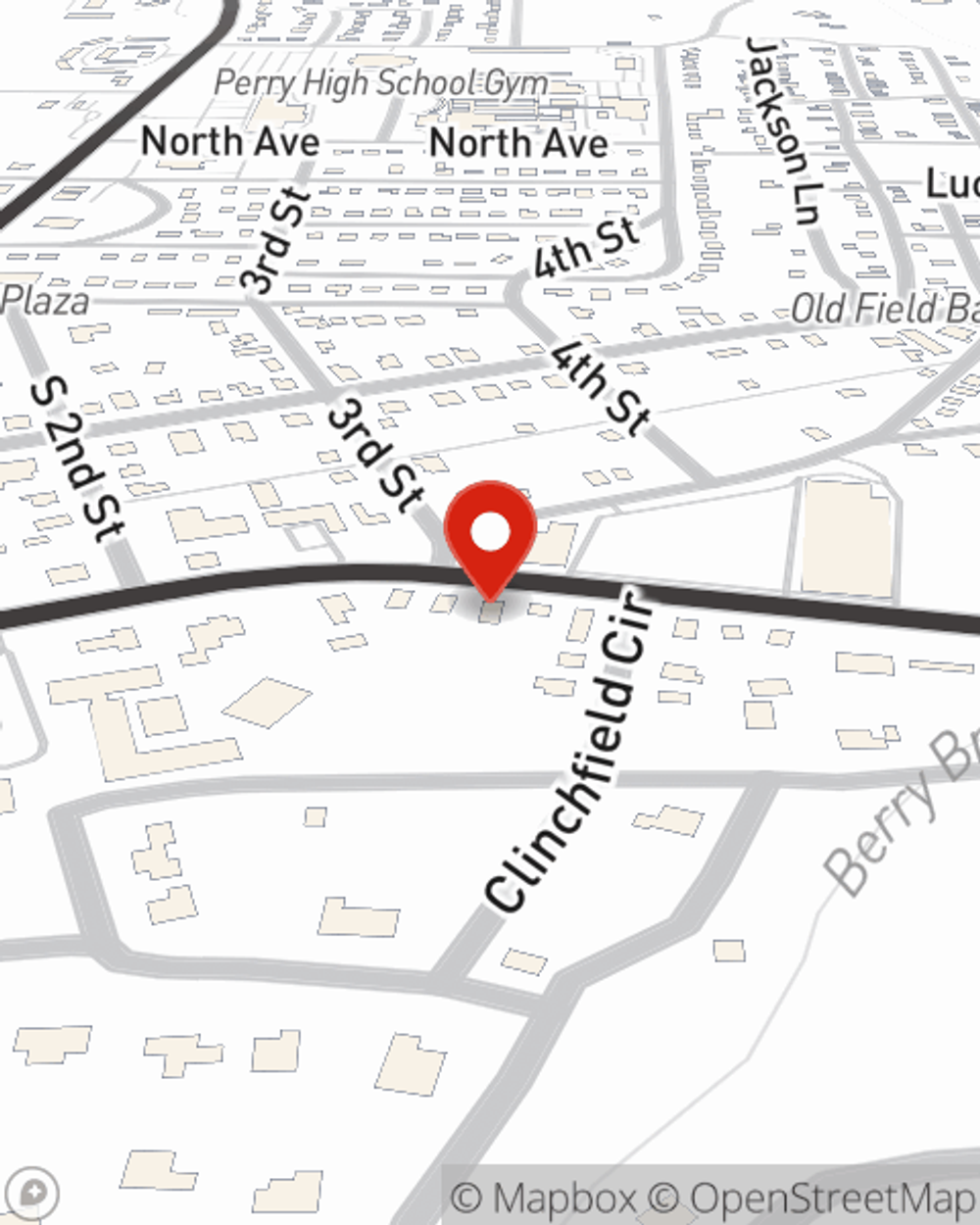

A good next step when renting a residence in Perry, GA is to make sure that you're properly insured. That's why you should consider renters coverage options from State Farm! Call or go online today and see how State Farm agent Nick Bedgood can help you.

Have More Questions About Renters Insurance?

Call Nick at (478) 997-3006 or visit our FAQ page.

Simple Insights®

Why should I consider doing home insurance reviews annually?

Why should I consider doing home insurance reviews annually?

You should review your home insurance coverage regularly to ensure you are properly covered. Here are some tips to have a good insurance review.

Getting rid of dust in your house

Getting rid of dust in your house

A dusty home can make asthma and allergy sufferers uncomfortable. Discover tips to help reduce or eliminate the amount of dust in your house.

Nick Bedgood

State Farm® Insurance AgentSimple Insights®

Why should I consider doing home insurance reviews annually?

Why should I consider doing home insurance reviews annually?

You should review your home insurance coverage regularly to ensure you are properly covered. Here are some tips to have a good insurance review.

Getting rid of dust in your house

Getting rid of dust in your house

A dusty home can make asthma and allergy sufferers uncomfortable. Discover tips to help reduce or eliminate the amount of dust in your house.